May 10, 2022

The global medical devices market is slated to reach $603.5 Billion by 2023. Fueled by major technology advances in diagnostic engineering, many medical devices are altering the way doctors approach preventive medicine. The future of modern medicine is being paved by novel medical breakthroughs aimed at providing more personalized patient-centric solutions. Termed as 'precision medicine', we can expect medical devices to present more opportunities towards this agenda.

Most notably, wearables are taking center stage and made to synchronize flawlessly with popular mobile technologies (i.e., smartphones, tablets). Therefore, it is safe to say the industry is meeting consumer demand in this space and efforts are being made to also blend with the needs of telemedicine.

Bloomer Tech's smart bra collects data on the cardiovascular health of the wearer. Photograph: Bloomer Tech

To the layperson, the definition of a medical device might appear confusing given the plethora of health and wellness type applications available. Because many wearables are offered and advertised in non-clinical environments, there are concerns about affordability and access. Medical devices that highlight an FDA clearance are apt to gain consumer trust, but many questions linger.

Patients often question their personal physicians for more clarity on how a particular medical device may improve health concerns. For medical device developers, it places a burden of education for both providers and patients.

Reaching a targeted audience can be tricky as many marketing arenas, where these products are sold, are not set up with a medical perspective in mind. Consumer affordability is also a major challenge such as in the case of insulin pumps. The need was there for many patients not being able to receive in-clinic treatments, but the high cost provided major obstacles for many out of network patients during the pandemic.

Most FDA cleared medical devices are geared toward an immunological, biological, or pharmacological application and required to prove its indication of benefit. While the definition of a medical device is broad in nature, they are classically defined as an instrument, apparatus, appliance, or software to be used for the medical-related purposes of:

In contrast, wellness devices carry an alternative definition and are distinct in the fact they highlight a lower risk associated with use and purpose. A wellness device is categorically built to aid a healthy lifestyle and intended to be used in a way that relates to maintaining or encouraging a general state of health or healthy activity.

Wellness tools are marketed and regulated with the accepted understanding that lifestyle behaviors may positively impact one's personal overall health. Regulatory guidance has limitations in place regarding the marketing of wellness devices to avoid consumer misperceptions. Claims cannot be made which may mistake a generalized wellness tool or device for specialized medical treatment modality.

Examples of wellness devices include:

An independent marketing agency speculates the number of health and fitness app users will stay above 84 million through 2022.

Medical devices for both the United States and Canada are categorized by an assessment of risk to patients during use.

USA Medical Device Classifications

Class I Medical Device

Generalized medical devices of this type are assigned a low to moderate risk to the patient. Examples of class I medical devices include non-electric wheelchairs, electric toothbrushes, and EKG machines.

Class II Medical Device

These represent about 40% of all medical devices and are said to have a moderate to high risk to patients. Examples include devices designed to monitor blood and body tissue such as glucose tests and pregnancy tests. Other examples include powered wheelchairs, contact lenses, and absorbable sutures.

Class III Medical Device

Class III medical devices are those with elevated risk factors and are often implanted within the body. Examples include cardiac pacemakers, breast implants, renal stents, cochlear implants, and defibrillators.

Health Canada Medical Device Classifications

Class I Medical Device

Consistent with US class I ratings, these are devices assigned the lowest risk to patients. Examples include syringes without needles, medicine spoons, spectacle frames, standard adhesive bandages, and examination lights.

Class II Medical Device

Class II is associated with minor risk to patients and include items such as short-term corrective contact lenses, suture needles, standard hearing aids, and TENS devices.

Class III Medical Device

These are medical devices with medium risk factors. Medical devices in this category are items such as sleep apnea monitors, ventilators, and diagnostic imaging devices.

Class IV medical Device

Class IV represent the highest risk to patients. Common medical devices falling into this category include pacemakers, breast implants, contraceptive IUDs, and any implantable devices containing pharmaceutical delivery.

Many clinical providers were thrust into telehealth offerings due to the Covid-19 pandemic. Virtual health appointments took center stage and patients were forced to navigate chronic conditions on their own. Without viable opportunities for routine in-home labs and monitoring capabilities, the demand for user-friendly medical devices to be used in home-care settings rose considerably.

Medical device development is still being met with eagerness from clinical stakeholders for many reasons; the primary being that it offers an avenue to cost savings. Portable and wearable devices showcase opportunities to treat and monitor conditions remotely, reducing the need fro in-clinic professional assistance. Additionally, longer hospital stays results in a higher economic burden. For these reasons, solutions within the medical device market have become increasingly more attractive to stakeholders.

Wearable technology is truly expanding at a rapid pace and presenting many exciting opportunities for all involved in the industry - particularly the end-users. While some wearables provide limited diagnostic features such as activity levels, heart rate, oxygen sensors, etc., others are dipping heavy into the medical device genre.

Recent wearable technology demonstrates life-changing possibilities in several novel clinical applications such as:

Though wearable technology is growing in popularity, it does come with regulatory concerns in relation to data privacy as diagnostic app developers work to push them into the medical device category. The medical community in previous years, has presented some concerns citing user practices, accuracy, privacy, and reliability. Wearable diagnostics are nevertheless a rich source of new data and potential clinical information.

The medical device development process undergoes rigorous protocols to determine its efficacy and safety. Specific procedures/protocols are followed throughout the full scope of the product development cycle, from ideation and the device specification through to product manufacturing and marketing.

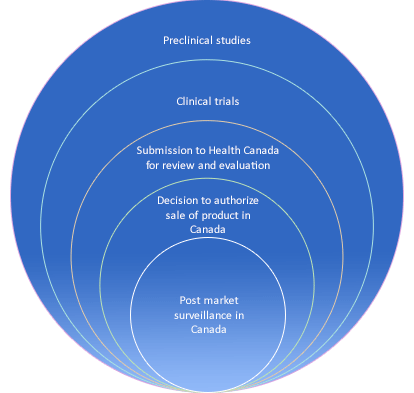

Similar to the FDA, Health Canada enforces stringent guidance protocols to regulate the roll out of medical devices. Both entities carefully oversee the methodologies used with respect to the design, manufacturing and facility quality controls, packaging, labeling, shipping, installation, and marketing.

The pathway to achieving medical device clearance in both the US and Canada are based upon the following benchmarks:

The key element in this regard is surrounded by consumer safety. Regulators in this space are considerably more lenient towards medical device clearance compared to pharmaceutical based approvals. This permissive landscape has a positive side as products can be marketed to consumers more quickly.

In support of this fact, the Medicines and Healthcare Products Regulatory Agency (MHRA) concluded an extensive consultation on the future regulation of medical devices in the UK with a goal of crafting an improved standard of patient-centric best practices and greater transparency.

Medical device development and diagnostic engineering professionals are paying close attention to what's working in this space and what's not. We know from statistics, there are an abundance of health and wellness apps, however, there is still a measure of slow adoption. Taking clues from early feedback based on early-version medical device models, developers are converging with stakeholders to dissect the key pain points and vulnerabilities. Exposing opportunities for improvements stand to benefit both providers and consumers.

As longevity practices fuel trends in wearable technologies, we can look forward to more in-depth diagnostic features that will ultimately be able to correspond in real-time with existing EMR based systems. The gains in artificial intelligence are fueling the momentum towards improved remote medical monitoring, but also pairing this technology with robust informatics. In some respects, we can speculate the medical device development space is just barely scratching the surface in terms of what's possible!

Further Reading:

If you enjoyed this article or know of anyone who would find it useful, please feel free to share on any social media platform.

If you have questions, please contact Ian Maclean on LinkedIn or through our contact page.

© 2019 Koven Technology Canada Inc.